CEO Confidence Highest since 2004

Will the economy rebound in 2021?

Corporate executives seem to think so.

According to the news site Axios, over 80% of CEOs participating in the quarterly Conference Board business roundtable see improved economic conditions in the coming six months, the highest confidence level since 2004.

Corporate leaders point to the recent success of vaccination programs as a major reason for renewed optimism.

Interest rates are also exceptionally low, which has made it easier for businesses and governments alike to finance debts. Inflation also remains low, for now at least, in part thanks to a drop in energy prices. (More on the specter of a return to inflation later…) Many analysts also believe that the Federal Reserve isn’t getting enough credit for assisting the economy during the downturn in 2020, including providing ready capital for jittery markets.

One negative for exporters is that we are in a strong dollar environment. The dollar’s continued strength has been boosted by investors across the world seeking a safe haven during difficult economic times. While this makes purchasing imports cheaper for US consumers, it does hurts American companies, such as manufacturers, seeking to sell their products overseas.

Wall Street and Venture Capital Investors Anticipate High Growth across the Board in 2021

The optimism of CEOs is shared by the stock market. Long seen as a leading economic indicator, the stock market has reached many new record highs this year.

Earlier this week, the Dow Jones Industrial Average closed at 33,527.19, a record high. The S&P 500 also hit a record closing high of 4,077.91, while the tech-heavy Nasdaq Composite climbed 1.7% to 13,705.59, not far off from its record high closing of 14,095.47 on February 12, 2021.

Can the Recent Gains in the Stock Market Help Us Identify Which Industries Will Grow the Most in 2021?

The short answer is no because investors are busy buying up just about everything on the markets, from companies that prospered during the pandemic – such as the Silicon Valley FAANG giants (Facebook, Amazon, Apple, Netflix, and Alphabet) — to stocks that were heavily battered by the pandemic, such as cruise lines.

If we were to pick one segment that stands out, it would be industries related to electrification, such as battery producers and electric car manufacturers or fintech stocks.

Take Tesla, for example. At times, its stock price has made the company more valuable than all the other car companies combined. Volkswagen has taken notice of this and has seen its stock price rise as it tries to mimic Tesla and become the Samsung in the market to compete with Tesla as Apple. (This metaphor will get too confusing down the road if the long-teased Apple electric vehicle ever comes to market.)

Despite an overall economic downturn, venture capital investment also remained strong during 2020, with M&A activity exceeding the levels of 2019. (Some analysts believe it may have already peaked.) As might be expected, many startup companies held back from launching IPOs during 2020, hoping for better returns once the economy rebounds. (VC investors are praying that the star-crossed IPO launch of the UK’s Deliveroo this past month is an exception, not the rule.)

2020 also saw the rise of SPACs (or Special Purpose Acquisition Companies) and their companion PIPE (Private Investment in Public Equity) funds, which have turned the traditional VC market on its head by allowing investors to raise capital first, then make startup company acquisitions later.

But the rise of unconventional investment vehicles, such as SPACs and PIPEs, has some analysts worried that there is too much money sloshing around trying to find good returns in today’s low-interest-rate environment. As further proof, they point to the case of Tesla, whose stock price far exceeds a reasonable price/earnings ratio, or to other current investing crazes, such as the meteoric rise of bitcoin and other cryptocurrencies, speculation in meme stocks like Gamestop, or the bizarre world of non-fungible tokens (NFTs), as evidence we could be in the midst of an “irrational exuberance” speculation bubble along the lines of the dot com era or even the Roaring Twenties.

Industries That Could Benefit from Government Stimulus Spending and Investments in Infrastructure and Green Technologies

The federal government is also pumping significant amounts of money into the economy.

The $1.9 trillion American Rescue Plan stimulus package passed earlier this year offers a lifeline to unemployed Americans as well as businesses in need (through the paycheck protection program) as well providing significant emergency financial aid to state and local governments.

But all eyes are on the Biden administration’s second act, the proposed $2 trillion American Jobs Plan, which – if passed in its present form – could dramatically change the economic prospects of many industry sectors.

Here are some of the key industry sectors which could see significant growth as a result:

· AEC Market (Architect, Engineering, Construction) Industry

The American Rescue Plan proposes to repair the country’s road infrastructure, retrofit or replace the nation’s 10,000 most dangerous bridges, as well as upgrading the top transportation choke points, including replacing transit tunnels in NYC and Washington DC. It also calls for significant infrastructure upgrades to passenger rail and transit systems, ports, and airports.

School construction would also spike under the plan, with extensive plans to modernize the nation’s K-12 school facilities, making them more environmentally sustainable.

The plan also proposes to upgrade Federal buildings (including the VA hospital system), which would also offer significant opportunities for the AEC industry.

· Healthcare

We mentioned upgrading VA facilities earlier, but there is more support in the bill for the healthcare industry, including increased funding for care homes for the elderly as well as support for enhanced child care for working families.

· Education

In addition to funding to modernize school buildings (see AEC bullet above), the bill would also fund new education initiatives to make education more accessible in disadvantaged areas.

· Research and Development

The proposed new legislation also proposes to significantly increase Federal financial support for R&D efforts through direct funding and more generous tax credits – a move that would provide a major boost to R&D laboratories. Dedicated funding will also support climate change research, including rare earth production, offshore wind energy production, carbon capture, and electric vehicles.

· Manufacturing Industry

The proposed new legislation would provide new support for the domestic manufacturing industry, including a preference for purchasing American-made goods in contracts financed by the legislation. This could result in a boon for manufacturers of raw materials such as concrete and steel, construction equipment, building materials, facility furnishings, HVAC equipment, as well as new transit and rail equipment.

Support for transitioning to electric vehicles (EVs) is also part of the plan, with financial support for additional American-made EV production, which will benefit traditional domestic vehicle manufacturers as well as new upstarts, such as the new Tesla competitor Lucid.

· Green Energy Technology

One of the major thrusts of the proposed legislation is to accelerate the shift to an environmentally friendly energy system. Suppliers of wind turbines (both on land and offshore), solar systems, battery storage systems, and other renewable energy sources would benefit greatly from the new proposed investments.

· Smart Grid Technology, including EV Charging and Broadband Access

As the recent failure of the energy grid in Texas demonstrated, there is an urgent need to upgrade our energy supply grids. The American Jobs Plan act would fund the development of an upgraded smart electric grid, which would support renewable energy sources, as well as create a nation-wide network of charging point for EVs. The plan also funds the rollout of a high-speed broadband access network to provide data access across the country, especially in underserved rural areas.

The “Wildcard” Factors That Could Change the Fate of Industries in 2021

If we have learned anything over the past year, it’s to be prepared for the unexpected. Here are a few “wildcard” factors that could dramatically change the outcome of different sectors of the economy in 2021:

· Tax Increases

If passed in its current incarnation, the $2 trillion American Jobs Act will require new revenue sources to pay for it. The current plan is to raise corporate taxes to 28% and increase the minimum tax on U.S. multinational corporations to 21%. (Fed chair Yellen has called for an international floor on corporate taxes to avoid a ‘race to the bottom.’)

There is considerable pushback to this idea, with some floating the idea of a carbon tax or a Tobin tax on financial transactions as an alternative.

· Inflation

As Fed chair Yellen notes, we have not seen significant inflation for over 10 years. But the threat is there, particularly if the Federal government continues to pump money into the economy.

· Manufacturing and Supply Chain Disruptions

One consequence of the Coronavirus pandemic was significant disruption to the global economy due to manufacturing and supply chain disruptions. Yet, as the recent Suez Canal blockage shows, it could happen again.

· Trade Wars

During the Trump administration, Washington argued with China over tariffs. But trade disputes are not going away. Now there is new trade tension over the boycott of cotton from Xinjiang province in China by international fashion companies due to human rights violations against ethnic Uighurs. (See also our recent article on how tariffs and trade barriers are affecting the furniture manufacturing industry.)

· Anti-Trust Actions

Will Silicon Valley giants such as Facebook face the prospect of anti-trust actions by the Department of Justice?

· Federal Legalization of Cannabis

The cannabis industry continues to grow rapidly as more states decriminalize their marijuana possession laws. Repeal of Federal cannabis legislation is on the table and could boost this growing industry to new highs.

· Oil Prices

After a disastrous plunge in oil prices, which forced many American fracking operators to shut their wells – or even go bankrupt – oil prices have recovered. It’s an open question of what will happen next. Could high oil prices put a pinch on an economy in recovery?

Industries That Did Well during the Coronavirus Pandemic Should Continue to Outperform in 2021

A few industries were well placed to withstand the economic downturn caused by the pandemic. These are the sectors that are likely to see continued success in 2021:

· Online Collaboration Tools

The breakout star in this category is Zoom, of course, but last December, Salesforce forked out $27.7 billion to acquire the work collaboration platform Slack.

· Entertainment Streaming Services and Games

In a world where most movie theaters remain shut, consumers have taken to entertainment streaming services instead. The upstart offering from Disney, Disney+, hit it out of the park, putting Netflix on the back foot. But despite Netflix’s lower market share, demand for streaming services and online games is expanding overall.

· E-Commerce and Fast Delivery Logistics

E-commerce sales hit record levels during 2020 as consumers sought alternatives to in-person shopping during the coronavirus lockdown. The logistics market supporting fast package delivery also surged to new heights and will continue to do so in 2021 as consumers show no sign of giving up their newfound online shopping habits.

· Data and Fintech

Online financial transactions are now the rule, rather than the exception, as people stayed at home during the pandemic. New low-cost stock trading apps, such as Robinhood, have opened up a new market with younger customers.

· Online Learning

Students were not the only ones to transition to online learning; many adults also took up online education, such as the popular duo lingo language system, during the pandemic. This trend is expected to continue, albeit at a slower pace in 2021.

· Real Estate

People were eager to leave cities for the suburbs and rural areas during the height of the pandemic, creating a real estate boom in non-urban areas. Thanks to flexible work from home (WFH) policies, many are planning to stay, and many more are looking to join them.

· Home Improvement and Residential Construction

With more people working from home, demand for home improvement projects increased to record levels to meet the demand for new home offices, back yard pools, bigger living areas, etc. However, this growth is now under threat, as increased demand for construction materials has outstripped supply, causing products such as dimension lumber to double in price.

· Home Gyms and Exercise Equipment

With people unable to visit the gym during the lockdown, there was incredible demand for equipping home gyms with exercise equipment, leading to months-long shortages.

· Recreational Vehicles and Camping Gear

The coronavirus pandemic helped us rediscover the great outdoors. Campgrounds are now full nationwide, and recreational vehicles are in short supply, with long waiting lists and significantly higher list prices.

The “Comeback Kids” Expected to Bounce Back with Strong Growth in 2021

But what about the industries that were hit hardest by the pandemic, such as restaurants, concert and sports venues, and even manufacturing?

Jobs in these hard-hit sectors are starting to come back. The most recent report shows that 916,000 jobs were added in March, but unemployment nationally is still about 2.5% higher than before the pandemic.

Despite the reported levels of unemployment, businesses are already reporting they are having trouble finding qualified workers, despite the high levels of unemployment.

Why is this?

One reason could be that older workers have given up and elected to retire early. Others point to generous unemployment benefits that keep workers on the sidelines. There is also evidence that healthcare workers and teachers who experienced extreme burnout during the pandemic are leaving their professions.

Despite these workforce issues, we expect the following industries to recover in 2021:

· Manufacturing

Manufacturing was beset with a multitude of issues in 2020, including Covid outbreaks in factory settings, major shortages of raw materials, tariffs on steel products, and delays in receiving components sourced from overseas.

But things are now back on the upswing. The Institute for Supply Management (ISM) reported this month that its index of national factory activity jumped to 64.7%, the highest increase since 1983.

· Leisure Travel

There is a lot of pent-up demand for taking vacations, visiting family and friends.

As vaccination programs continue, Americans will once again look forward to road trips, flights to vacation destinations, hotel stays, and cruise vacations.

· Restaurants

Another sector that will bounce back is the restaurant industry. Many establishments had to close their doors permanently during the pandemic, but demand should return to encourage new ones to take their place. One open question is whether the home delivery market will continue to stay strong at the expense of in-person dining.

Not all businesses will return to pre-pandemic levels during 2021. We see caution flags for these industry sectors:

· Retail Stores

Consumer preference for online shopping may have reached a tipping point in the pandemic. Of course, retail stores will reopen, but there will be fewer of them, and they will have to create creative ways to stand up to online sales alternatives. Nonetheless, UBS predicts 80,000 stores will close by 2026.

· Business Travel

Business travel may not return to pre-pandemic levels as salespeople and other frequent business travelers have learned to adapt (or even prosper) by conducting business over Zoom conference calls. This will have a significant knock-on effect for airlines, upscale hotels, and restaurants that cater to business travelers, as well as convention centers around the world.

· Entertainment Venues

It’s not clear how quickly the public will want to return to the crowded theater, concert, and sports venues. These businesses remain at risk for 2021.

For Job Seekers: the Top in Demand Careers for 2021 and Beyond

What are the best job opportunities for those looking for a new career?

· Manufacturing and Construction Trades

Labor shortages in the construction trades and the manufacturing sector are helping drive up wages as companies seek to recruit and retain the best workers.

· Software Developer, Data Analyst, AI Researcher

Big data, machine learning, and AI-driven data analysis are at the core of modern business operations. Demand for candidates in these fields is at an all-time high.

· Finance Technology (Fintech)

Banking and finance are also becoming more data-driven, which is driving demand for specialists who can manage finance data or create customer-facing applications.

· Digital Marketing

Stoking demand for online sales requires a unique set of skills that blends brand management, content development, and sophisticated customer data analysis.

· Logistics Management

The boom in online commerce and rapid package delivery has boosted demand for experts who can create efficient systems to manage supply chain logistics.

· Sales and Support Specialists

As products and services become more complex, customers want access to expertise when making important purchasing decisions or seeking post-sale support.

· Healthcare

The pandemic has highlighted the importance of our healthcare system, and as society ages, the demand for healthcare workers continues to grow significantly.

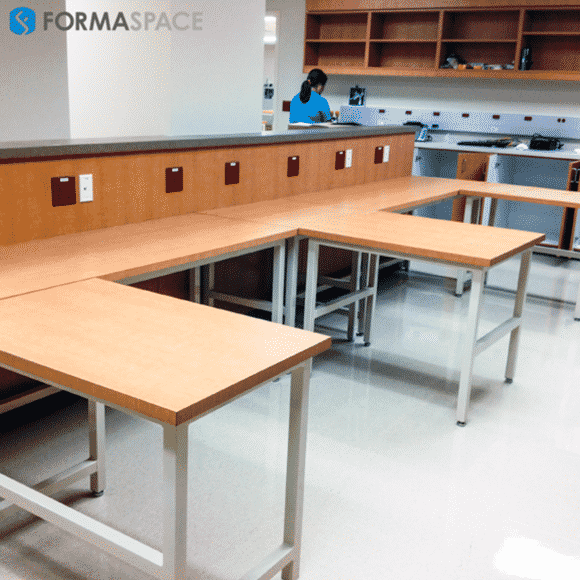

Formaspace is your Business Partner for Flexible Facility Management

If you can imagine it, we can build it.

Formaspace has the expertise to help you get the most out of your facility, whether it’s an office, a manufacturing facility, a laboratory, or an educational institution.

Our custom furniture solutions are built-to-order here at our factory headquarters in Austin, Texas.

Talk to your Formaspace Design Consultant today and find out why companies such as Apple, Capital One, Dell Computer, Oculus, SpaceX, Toyota, and more choose Formaspace furniture.