The news kicked off a little early this week — on Sunday — starting with a huge demonstration march down Broadway in New York City in advance of the climate change discussions taking place this week at the United Nations. We thought it might be useful to try to understand (and predict) what kind of changes that industries like manufacturing will face in the coming 10 years with respect to climate change regulations, cap and trade regulations, potential carbon taxes, renewable energy sources and the electrical grid.

Yesterday, President Obama addressed the United Nations General Assembly as part of a one-day Climate Leadership Summit meeting under the direction of UN Secretary-General Ban Ki-moon. Obama reiterated the importance of all nations coming together to agree on a global plan by the end of 2015. “The climate is changing faster than our ability to address it,” Obama reasoned. ”The alarm bells keep ringing.” Disappointingly, neither Chinese nor Indian heads of state attended the summit. Yet Obama did call out China by name, saying the most populous nation on earth — with the fastest growing rate of carbon pollution — must join the rest of the world in reducing carbon emissions. Critics may argue that this event is just another one of the many meetings on climate change that have taken place since the Kyoto Protocol was drafted back in 1997 and — like so many other summits and conferences — it won’t result in much of anything in the long run.

The critics may be right on this point. Even the most enthusiastic advocates of placing controls on carbon emissions — be it through cap and trade, carbon tax or emission quotas — would agree that the Kyoto Protocol failed to live up to its promises. It expired in 2012 without ratification by the U.S. Congress. But the same group of environmental advocates could also point to the success of the Montréal agreement which regulates ozone-depleting gases like Freon used in refrigeration equipment. It’s widely accepted that Montréal agreement saved the Earth’s ozone layer – thanks to a comprehensive international agreement.

Can Lightning Strike Twice?

Possibly. There really are signs things could be different this time. Case in Point #1: Heirs to John D. Rockefeller’s Standard Oil fortune announced this week they would divest their investment portfolios of any fossil fuel industries. This certainly has a lot of symbolic weight. Even climate change skeptics have to ask themselves if this is a publicity stunt or if there really is a legitimate business case at work for moving away from investments in the coal, oil and gas industries.

Case in Point #2: In advance of yesterday’s UN Climate Leadership Summit, the World Bank made a surprise announcement that they were in favor of establishing a price (e.g. tax) on carbon pollution. Further, the World Bank has already received commitments from 73 countries, 22 states, provinces and cities and over 1,000 businesses and investors in support of a carbon pricing system. Given the historically conservative nature of the World Bank, this is really quite a startling change. If we see additional influential announcements from other nations and high-profile organizations supporting a worldwide agreement on a carbon tax, then next year’s 2015 Paris meeting might be successful in setting a plan in place to address the role of carbon emissions and climate change after all.

What are Some of the Reasons Favoring a Carbon Tax Over Cap and Trade Regulations or Carbon Emission Quotas?

In an era when taxes are as unpopular as ever, how could the world’s nations ever agree on imposing a new universal tax? For an explanation, we turn to Morris University Professor Dale

Jorgenson, who has been studying the relative merits of different mechanisms for controlling carbon emissions. Professor Jorgenson recently spoke to Harvard magazine in an extensive interview, where he explained that while all these different approaches— taxes, quotas or Cap and Trade — could reduce carbon emissions effectively, only a carbon tax would also provide something that governments around the world are desperately seeking: a source of revenue.

As an Economist, Jorgenson Then Asks: “What Should Governments Do with this New-found Source of Funds?”

In his view, the most efficient use of the income generated by carbon tax would be to reduce costs of capital. Whether you agree with this approach — or not — we think you’ll find reading the entire article quite interesting and informative. By tying a carbon tax to reductions in taxes on capital, we do think that Jorgenson has identified a mechanism which will garner the support of the world’s financial titans. Therefore, it does raise the chances of a worldwide agreement in Paris during 2015. Jorgenson also points out that for a Carbon Tax system to work there would have to be a universally agreed-upon price for taxing carbon emissions — and that every nation must participate to avoid freeloaders trying to game the system.

But How Do We Determine the Price of Carbon Emissions? What Would the Cost of a Carbon Tax Be?

For that we turn to Bill Nordhaus, Sterling Professor of Economics at Yale. He proposes a price of about US$30 per ton of carbon emissions. We’ll take Nordhaus at his word; you can dive into his book, The Climate Casino, for more details. If a potential 2015 agreement in Paris supporting a universal carbon tax seems far in the future, you’re right. But wait. There’s a quiet revolution in renewable energy production taking place in Germany. In fact, what’s been happening in Germany recently is so significant it may push any eventual carbon tax off to the sidelines.

What’s Germany Doing that is So Significant in the Energy Market?

After jettisoning the last of its nuclear power plants after the Fukushima earthquake nuclear disaster in Japan, Germany is more determined than ever to remake its entire electricity system — essentially from scratch. Their new focus is on renewable wind power and solar energy. The German electrical grid is being redesigned to incorporate the flexibility needed to support widely disparate power sources — ranging from huge offshore wind farms in the North Sea to individual apartment complexes and homes with solar cells on their roofs. Germany has also restructured the entire electricity consumer payment system. They have created a system with long-term contracts for small energy producers, called feed in tariffs, which provide stability in the market and enable financing for investing in renewable energy products — like solar panels and wind turbines.

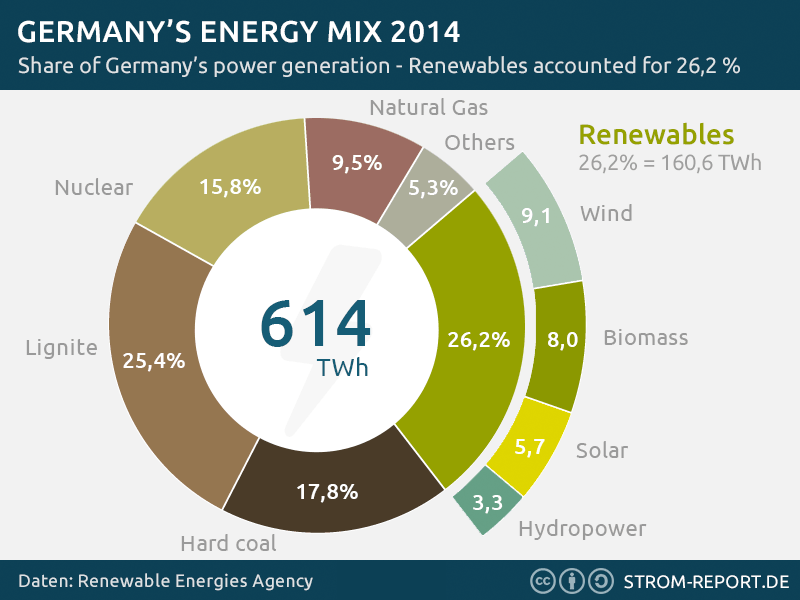

There’s no question it’s a work in progress, but their progress has been incredibly rapid. Already, Germany is close to producing 30% of its power needs from renewable energy, which is twice as much as the United States. Germany’s strong economy in recent years has helped bankroll their heavy investments in renewable energy. In fact German investments in renewable energy products have been so large that they’ve really driven the market demand curve in ways that many US manufacturers did not anticipate, much to their detriment.

By creating rapidly increasing demand for things like solar panels and electrical grid controllers, Germany has become dependent on Chinese manufacturers who were able to stay in business even as intense competition has driven down equipment prices as much as 70% in the last decade. As we’re sure you are aware, most American solar manufacturers have struggled and quite a few have ended their operations in bankruptcy. (You may recall we recently discussed the GT Advanced Technology plant in Mesa AZ making sapphire for Apple. It operates on the site of a former bankrupted solar panel manufacturer.)

The Big Question for American Energy Utilities

American utility companies are on the horns of a dilemma. As fracking produced a natural gas bonanza, many electrical utilities were forced to convert their existing coal powered electrical generation plants to natural gas. They now have to consider whether or not a future agreement on a universal carbon tax in Paris in 2015 will further tip the balance toward renewable energy sources like wind and solar.

Yet it may be the Germans who — at the end of the day — become the most influential of all in the world energy market thanks to their relentless buying power that continues to drive down the costs of renewable energy equipment like wind turbines and solar energy cells. And if you think utility companies in the U.S. are concerned, it’s likely that energy companies heavily invested in fossil fuel production are doubly so. It may be easier to block a political consensus around a carbon tax, but once consumers begin to see the potential for generating their own electricity from sunlight, the equation for fossil fuels changes rapidly. After all, it’s quite possible that the offspring of oil giant John D. Rockefeller are onto something.

Formaspace Can Help You Stay at the Cutting Edge

No matter how market conditions for energy may change, Formaspace is here to help. Our American-made technical furniture solutions are flexible, reconfigurable and long-lasting. In fact our 12 year, 3 work shift furniture guarantee is the best in the industry. Join the roster of satisfied Formaspace technical, manufacturing and laboratory furniture clients — including Apple Computer, Boeing, Dell, Eli Lilly, Exxon Mobile, Ford, General Electric, Intel, Lockheed Martin, Medtronic, NASA, Novartis, Stanford University, Toyota and more.

Give us a call today at 800.251.1505 to find out more about the Formaspace line of stock, semi-custom and custom-made computer workstations, industrial workbenches, laboratory furniture, lab benches and dry lab/wet labs — as well as our design / furniture consulting services.