We had the opportunity to meet up with industry consultant Amanda Schneider to talk about the revolutionary changes she sees coming in the contract furniture market and the impact these changes will have on furniture dealers, manufacturer reps, and manufacturers, including Formaspace Office. You may know Amanda from her research-led strategy firm, Contract Consulting Group, which helped produce the CBRE Furniture Forums in Chicago and Washington D.C., as well as her recent high-profile articles in the Business of Furniture Magazine and HuffPost.

What are the Major Changes Taking Place in the Contract Furniture Industry Today?

To kick off our interview, we cut right to the chase. We wanted to know what Amanda thought about ancillary furniture sales jumping up from 20% of the floor plate to as much as 50% (or even 60%), but before we could finish, she cut us off — with a smile in her voice. “I actually think we need a new word for ancillary at this point!”, she interjected. Ancillary can’t be called that anymore if it outsells primary!

We offered our apologies for using the A-word, but pressed on, with all of us agreeing to try to come up with a new industry term to replace ancillary. So back to our question: What’s the number one reason for ancillary taking off?

In Amanda’s view, office technology is the primary market disrupter: it’s freed us up from being tethered to CPUs, keyboards, cubicles and the like. No longer tied down by technology, we can move around the office, to work in a wide variety of non-traditional office settings, ranging from casual touchdown spaces with impromptu seating areas to shared benching or desking areas. Amanda notes this trend will only accelerate in the future as wearable technology becomes mainstream, and that we’re starting to see glimpses of that now.

The second reason for ancillary’s rise, according to Amanda, is a major generational shift. Younger workers are making their presence known, by questioning everything about the work environment, from the traditional corporate office ‘look and feel’ to what’s considered OK to wear to work every day. This questioning process, Amanda contends, is pushing us towards a more “hospitality and residential” feel in the office, which, in turn, is driving more ancillary furniture sales — think carpets, warm residential lighting and the like.

The third thing driving ancillary sales upward, in Amanda’s view, is the trend toward unique “curated” office spaces. This highly-personalized design aesthetic, which seeks to communicate key branding messages that are unique to each company, not only requires more A&D design hours, it’s also nudging dealers and manufacturers to carry additional lines to satisfy the market’s growing demand for unique ancillary products — including those in the custom category. In fact, Amanda predicts that custom “will be one of the biggest growth areas of our industry.”

Amanda’s Predictions for the Future of the Contract Furniture Industry

Amanda had already given us three solid reasons for the rise of ancillary.

Now we wanted to know if she had three takeaways for the future of the contract furniture industry as a whole, including any specific predictions she had for manufacturers, furniture dealers or manufacturer reps.

Amanda didn’t hesitate; she staked out a bold claim: “The way we’ve worked historically is NOT how we’re going to be working in the future.”

She went on to elaborate on about the research information she gleaned by partnering with Julie Degman, Director of Furniture Advisory Services at CBRE, to create the CBRE Furniture Forums in Chicago and in Washington, D.C.

The CBRE Furniture Forums were designed to take a deep dive into the structure of the industry, with a goal of identifying things like customer pain points, then devising solutions to make things better in the future. According to Amanda, what they uncovered in D.C. and Chicago (despite their well-known reputations as very dissimilar markets) is that everybody needs to rethink the fundamental assumptions we have about the contract furniture business.

“How so?”, we asked.

What’s happening, Amanda says, is that purchasers are increasingly taking on what she calls the “Amazon Customer mindset”: they want easy, instant online purchasing.

As a result, Amanda’s first prediction for the future is we need to move away from our “Educate! Educate! Educate!“ “relationship-based” sales mindset to one where we focus on “How do we make things easier for customers. Don’t teach me (about choices). Make it easy for me.”

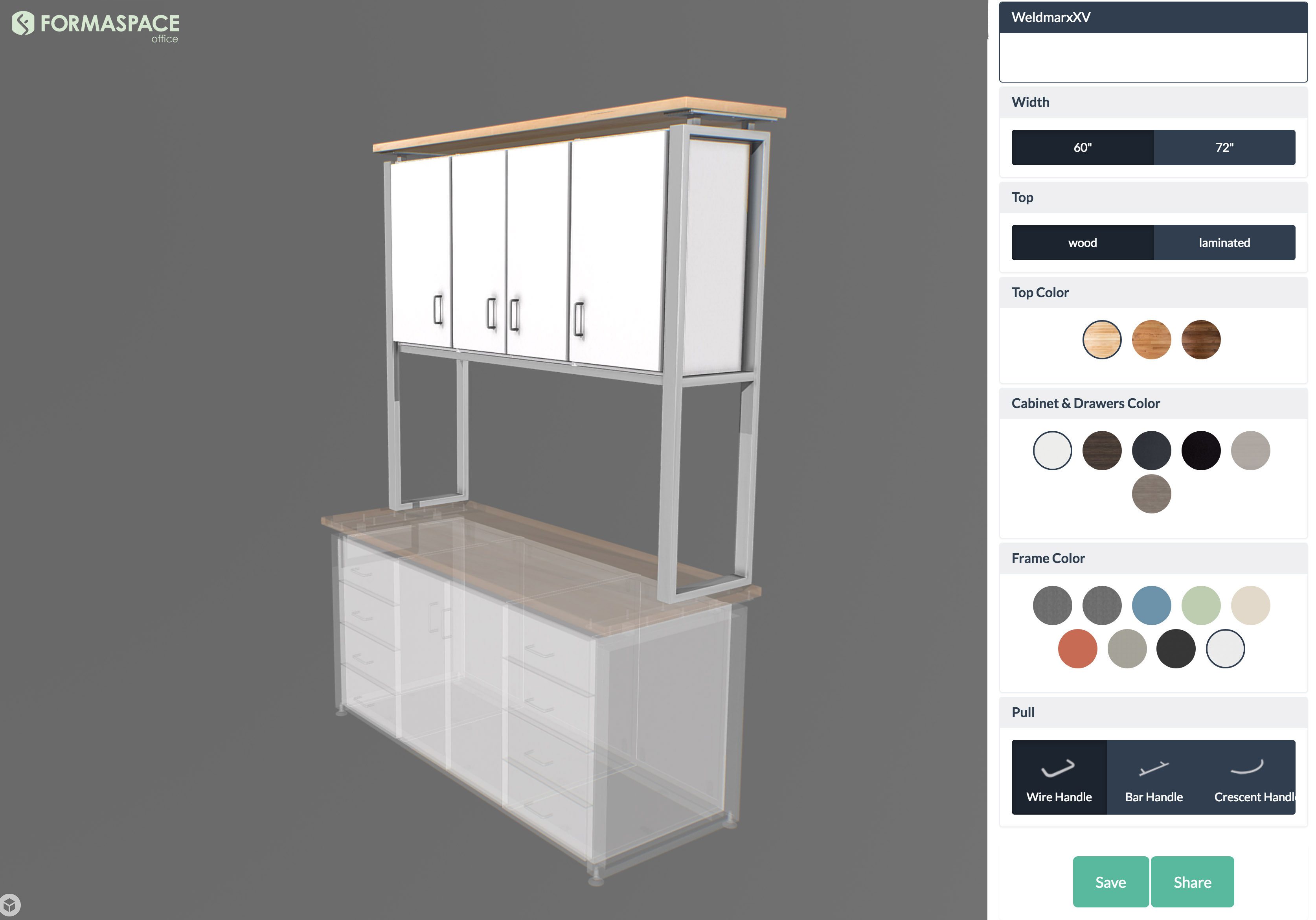

One consequence of this, Amanda believes, will be the increasing importance of online configurators as part of the sales process. (Look for Formaspace Office to introduce our next-generation online 3D configurator in November.)

Amanda continues: We have to start looking at the whole ordering process to make it easier. As the demand for unique products on each job goes up, so does the number of individual manufacturers involved. It’s taking more man-hours, more labor hours, and more design-time hours to get all of this work done — but the available hours (set forth in project timelines) aren’t getting adjusted upward to reflect all the additional work. That means more complexity is rolling down to the dealer. That’s reason enough to simplify the online ordering process to make it easier. It’s all about leveraging digital tools to make the buying process easier.

We agreed with Amanda wholeheartedly, pointing out that increased project complexity is also affecting manufacturers like Formaspace Office as well.

The second prediction about the future? Custom has the potential to be a very significant growth area — but only if we can figure out how to make custom easy.

Amanda believes we have to start looking at how to give people custom choices without making the ordering and the pricing process so cumbersome. She has a favorite example: Ordering breakfast. You to the waiter: “I’ll have the whatever omelet.” The waiter to you: “Do you want toast or English muffin? Do you want hash-browns or fruit? Do you want…” By the time they’ve asked you the sixth question, you’ve given up: “Just bring it to me, whatever it is! Give me some food!”

We need to make it understandable, not by amping up the old “Educate me!” sales approach but by walking people step-by-step through the configuration and pricing process. Amanda feels that our industry can do this, e.g. focus on e-commerce. “Actually, e-commerce may not be the best term to describe it,” she adds. “but my point is we need to make these online electronic sales tools easy to use.”

(To learn more about Amanda’s views on the ways e-commerce needs to change, read her latest article in the Sept 27 issue of Business of Furniture.)

What’s Amanda’s third and final prediction?

Amanda believes we have to look at the value of service; this was one of the eye-opening revelations from the CBRE Furniture Forums, she says. It’s a lot easier to talk about margin when you have a tangible thing, like furniture. But, when you talk about the intangible things, like what designers do for you at the A&D firms, or when you talk about the pure services that dealers provide, that’s a harder conversation.

Amanda hopes that our industry can find a way to value service because it’s hugely important. “I think for a long time this industry has done a lot of things that maybe don’t make sense — we all know that they don’t make sense when we walk out of a meeting shaking our heads thinking: ‘This doesn’t make any sense but I’m going to do it anyway because it’s for the good of the group.’ I hope that we can find a way to really value service (and elevate that service level as well) because I think it will benefit our service industry as a whole.”