Thanks to large subsidies offered by the Inflation Reduction Act (IRA) that encourage the development of a North American-based energy storage industry, we are seeing unprecedented investment in not only North American battery manufacturing but also in domestic mining and refining operations for minerals, such as lithium, used in energy storage infrastructure.

US Ranks a Distant Fifth in Worldwide Lithium Production

When it comes to lithium production, the US has plenty of opportunities to grow.

That’s a nice way of saying we rank far below the worldwide leaders in lithium mineral production. According to the United States Geological Survey (USGS), we come in fifth behind the leader Australia (61,000 tons in 2022), followed by Chile (39,000 tons), China (19,000 tons), and Argentina (6,200 tons).

What’s the reason for this?

While many have assumed that high-quality lithium deposits are only found in certain parts of the world, the USGS now reports that the US has 9.1 million tons of identified lithium reserves (found in a combination of continental brines, geothermal brines, hectorite, oilfield brines, pegmatites, and searlesite).

While this is significantly less than the reserves in Bolivia (estimated at 21 million tons) and Argentina (19 million tons), it’s roughly equivalent to the estimated reserves held by Chile (9.8 million tons).

The underlying reason for low US lithium extraction is straightforward. Currently, we only have one active mine in production, the Silver Peak evaporative lithium brine extraction plant in Esmeralda County, Nevada. Silver Peak is owned and operated by the US-based Albemarle Corporation mine produces lithium carbonate, which is.

The USGS won’t publish Silver Peak’s actual production numbers as they are considered a trade secret, but analysts estimate the Nevada mine produces around 5,000 tons of lithium annually. A local Nevada newspaper report estimates Silver Peak only produces 1% of the world’s mined lithium, and Mining.com ranks the Silver Peak as the 10th largest in the world outside of China).

The US also lacks Significant Lithium Processing Capacity

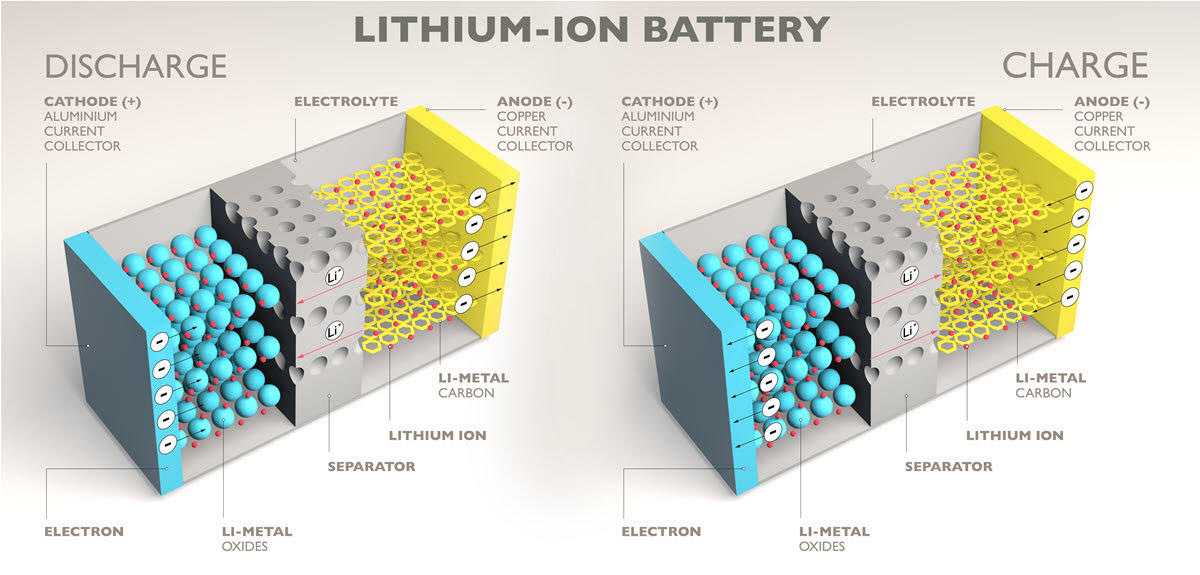

The other component hindering domestic production of lithium is sufficient refining and processing capacity. As we mentioned earlier, Albemarle’s Silver Peak plant produces lithium carbonate, which requires further processing to make products such as Lithium-Ion batteries. Albemarle has processing plants outside the US; so does its competitor Livent, which recently acquired the Australia-based Allkem company. But Livent is the only one with a dedicated domestic lithium processing plant – a specialty facility in Bessemer City, North Carolina. However, Livent plans to operate a much larger dedicated lithium processing facility in Bécancour, Québec by 2025, and Elon Musk recently solidified plans to build a brand new lithium refining and process plant near Corpus Christi, Texas.

These two new plants will help shore up the North American lithium processing capacity, but more capacity will be needed to create a large-scale domestic lithium supply chain.

Promising Lithium Deposit Hotspots Across the US that Might Prove Viable for Extraction Operations

As we pointed out above, the USGS estimates the US has 9.1 million tons of lithium ore reserves.

This leads to two questions… first, where are these deposits located? And second, which are the most economically and environmentally sound deposits to pursue?

As we’ll see shortly, these are difficult questions to answer, and in response, the USGS has teamed up in partnership with DARPA to leverage Artificial Intelligence (AI) tools to pinpoint the most promising domestic mining sites.

Meanwhile, here are some of the most promising regions currently under consideration:

· Arkansas

Standard Lithium Ltd., in partnership with LANXESS corporation, is investigating the “Smackover Formation,” which stretches from northeast Texas across upper Arkansas down through Mississippi to the Gulf Coast of Alabama and the far west tip of the Florida Panhandle as a potential source of lithium brine. Standard Lithium has two announced two lithium extraction projects, the Lanxess Project and the South West Arkansas Project.

· California (Salton Sea)

Standard Lithium Ltd. is also pursuing lithium deposits in the 45,000-acre Bristol and Cadiz Dry Lake projects in the Mojave Desert in San Bernadino County, California.

The Salton Sea in Imperial County was once a boaters’ paradise in the 1950s but today, it is an environmental disaster in the making due to increasingly toxic waters and blowing dust from its rapidly receding shorelines. However, it may yet have a third act as one of the world’s major sources of lithium ore. Lilac Solutions is one of several companies pursuing projects here; Lilac plans to use ion exchange beads to extract lithium from the Salton Sea’s briny waters.

· Maine

Geologists have identified what has been called the highest concentration of lithium-bearing crystals in the world, with some estimates of reserves as high as 11 million tons. However, Mainers are skeptical about the idea of hard rock mining operations in the state; Maine outlawed mining metals in open pits greater than 3 acres in size in 2017.

· Nevada

We’ve covered the Silver Peak mining operations earlier. But Nevada has nearly 20,000 mining claims that could prove to harbor additional lithium deposits, including American Battery Technology Company (ABTC) and its ABTC Tonopah Flats Lithium Project claim, as well as Jindalee Resources Ltd.’s Clayton North project — both located just a few miles north of Silver Peak.

Another area receiving a lot of attention is Thacker Pass in northern Nevada, a sacred indigenous site known as Peehee Mu’huh, which has led the local tribes to bring litigation against the Lithium Nevada company to prevent mining activities there. Despite these concerns, GM has invested $650 million in the Canadian company Lithium Americas to develop the Thacker Pass mine.

· North Carolina

After World War II, nuclear weapons engineers used lithium deuteride sourced from King Mountain, NC (an inactive mine site now owned by Albemarle, owner of the Silver Peak mine in Nevada) to create the first thermonuclear weapons (aka hydrogen bombs), including the infamous 1954 Castle Bravo nuclear test which proved to be 2 ½ time more powerful than predicted. Recent efforts to reopen the Kings Mountain mine have been met with stiff resistance.

· North Dakota

In contrast to Maine and North Carolina, North Dakota is known to be very pro-mineral extraction; oil and gas fields have become a main driver of the rural state’s economy. Recently geologists from the North Dakota Department of Mineral Resources published a paper outlining the potential of a high concentration of rare earth minerals (including lithium) within the Bear Den Member of the Golden Valley Formation in the west-central part of the state, which is funding the research through the North Dakota Geological Survey. The US Department of Energy has also awarded the University of North Dakota researchers $8 million to study the feasibility of building an extraction and processing plant to extract lithium from lignite coal deposits in Grand Forks.

· Oregon

Perth, Australia-based Jindalee Resources Ltd. is also investing in a partnership with POSCO Holdings to develop the McDermitt Clay Lithium Project on the border of Nevada and Oregon. The companies claim this is the largest lithium deposit in the US and has aspirations to be a major lithium supplier to the new US lithium energy storage factories now on the drawing board.

Could AI Help Pinpoint the Location of Promising Lithium Deposits?

Interpreting geological survey data is hard.

It takes a lot of expertise and experience to interpret large amounts of geological survey data.

Given the success that other related data-intensive research projects have had using AI-based tools, couldn’t AI be used to sort through and identify the most promising lithium mining sites?

The answer is yes, according to a new paper, Predicting new mineral occurrences and planetary analog environments via mineral association analysis, published by researchers at the Carnegie Institution for Science, Rensselaer Polytechnic Institute (RPI), the University of Arizona, and the University of Notre Dame.

This research consortium investigated the potential for using AI techniques to predict the location of new mineral deposits based (in part) on existing mining data. In layman’s terms, if you know mineral X is in this location, you can pinpoint the associated mineral Y nearby based on the way mineral groups tend to cluster together as a result of complex changes in Earth’s geology over millions of years.

To accomplish this, the researchers developed a mineral evolution database of nearly 5,000 mineral types across 300,000 known locations which in turn informed the machine learning model used to predict the most promising areas to find new minerals, especially highly sought-after rare earth elements and other in-demand minerals, such as lithium.

DARPA and the USGS investigate AI-based Automation to Pinpoint New Sources of Lithium Mineral Deposits in the US

In 2022, USGS and DARPA teamed up to create a contest dubbed the AI for Critical Mineral Assessment Competition.

The idea behind the concept is to create new AI / Machine Learning (ML) techniques to speed up / automate the traditional labor-intensive steps required to assess the nation’s critical mineral resources. To underscore the scope of the problem, DARPA says that unless something changes, we won’t be able to assess the 50 critical minerals fast enough to address current-day supply chain needs.

The contest was set up in two challenges. The first was to use AI tools to automate the tedious task of “Georeferencing” data from satellite images, e.g. matching the digital data with known coordinates on the ground. The second was to automate map feature extraction; as the name implies, this is the process of identifying unique features within large data sets, allowing them to be further analyzed.

The competition winners were announced in December 2022:

The Canadian “Team Uncharted” landed the first prize in the Map Georeferencing Challenge. “Team Jataware” won second prize, and “Team Ptolemy” (a consortium of MIT, Penn State, and the University of Arizona, received third prize.

The winner of the Map Feature Extraction Challenge was a team from USC’s Information Sciences Institute and the University of Minnesota. “Team ICM” from the University of Illinois got the nod for second place, and “Team Unchartered” won a second time, taking third place in the challenge.

Hosting this competition and its associated hackathons also helped inform USGS and DARPA of the potential for using AI-based techniques to speed up the process of evaluating geologic maps of critical minerals.

Concurrent with the launch of the competition, DARPA issued a new opportunity (e.g. RFP) to solicit proposals for a new program it calls the Critical Mineral Assessments with AI Support (CriticalMAAS).

The new CriticalMAAS program is prompted by the Energy Act of 2020, which mandates that the USGS assess the US supply of critical mineral resources as well as the Bipartisan Infrastructure Law, which mandates that the USGS investigate whether critical minerals can be extracted from existing mine waste.

As is typical for these research proposal tenders, it’s broken down into multiple phases and different technical areas (TAs).

In this case, the CriticalMAAS RFP opportunity is broken into a first phase (a one-year Feasibility Study) and an optional second phase (a six-month Proof of Concept). There are four Technical Areas that indicate where the USGS and DARPA think researchers need to focus their efforts:

- TA1 – Extracting geospatial data from maps and documents.

- TA2 – Model extraction from knowledge.

- TA3 – Mineral potential mapping exploiting multi-modal fusion.

- TA4 – Human-in-the-loop learning (HITL) and mixed-initiative modeling.

We’ll be looking for news about CriticalMAAS in the coming months – to track any contract award winners and the results of their research efforts.

Private Companies Are Investing Heavily in AI-Based Tools to Find New Mineral Resources

Two privately-held companies are making headlines in the mining exploration field.

The first is Earth AI, which has inked a deal with Australian mining company Tivan (formerly TNG Limited) to use their AI-based mineral exploration tools to identify promising deposits in the 8,000 sq kilometer Sandover project near Mount Peake in Australia’s Northern Territory.

The second company is KoBold Metals, which was founded in 2018 and has a large number of business celebrity investors, including Jeff Bezos, Michael Bloomberg, Richard Branson, and Bill Gates. Kobold Metals calls its AI-based platform the “Machine Prospector,” and one of its initial targets was finding cobalt deposits. In 2022 it invested $150 million to develop the Mingomba copper-cobalt mine in Zambia and has exploration projects across Canada and Western Australia. Kobold Metals recently raised $200 million for lithium and copper deposit projects. In light of the new funding, investment bankers are valuing the company at more than $1 billion, a milestone that puts it in Silicon Valley “Unicorn” territory.

Formaspace is Your Laboratory Research Partner

If you can imagine it, we can build it here at our factory headquarters in Austin, Texas.

Take the next step. Contact your Formaspace Design Consultant today to find out how we can work together to make your next lab construction or renovation project a success.