Lost Opportunities – How US Chip Manufacturing Moved Overseas

Consumers outside the electronics industry might be shocked to learn that 90% of the high-end microchips that power our latest gadgets, such as smartphones and computers, come from one overseas location – Taiwan – where market leader TSMC (and its rival USM) produce leading-edge chips sized 7 nm or smaller.

Writing in his book Chip War, author Chris Miller points to a turning point in American semiconductor manufacturing, when Texas Instruments (which helped create the microchip industry) failed to promote their successful executive, Taiwanese-born Morris Chang.

Disillusioned, Chang left the company, ultimately returning to his homeland, where he founded TSMC.

The CHIPS and Science Act – Will New Federal Industrial Policies Bring Chip Manufacturing Back to the USA?

Analysts agree that our outsized dependency on advanced microchip production in Taiwan is a considerable strategic risk for the USA. The small island nation of Taiwan is vulnerable to disruption; it not only faces the threat of invasion from China, it’s also susceptible to major earthquakes and, more recently, droughts, which required TSMC to truck in water to support its factory production.

In response, Congress, in a rare, bipartisan vote, passed the CHIPS and Science Act in 2022, ushering in a new industrial economic policy designed to bring back domestic chip production. The legislation offers $52.7 billion in subsidies to support creating new semiconductor fabrication plants (commonly known as FABs), and a 25% investment tax credit for upgrading existing FAB facilities in the US. To date, over 145 companies have made applications to tap into the subsidies.

An Inauspicious Start to Reshoring: Intel’s Big 7nm Misfire and Foxconn’s Broken Promises in Wisconsin

Critics of this new government industrial policy are eager to point out that earlier attempts to save the US microchip industry, such as the Sematech program, were ineffectual.

Government promises were also broken in Wisconsin, where Foxconn (assembler of many of Apple‘s iPhones) failed to deliver on a deal to build a major electronics manufacturing facility.

Missteps by America’s largest chip manufacturer, Intel, which failed in its attempt to compete with TSMC in producing 7nm chips at scale, have not helped either.

Some analysts believe that Intel’s lapses led Apple to develop its own M series chips for its latest iPhones, which are manufactured at TSMC overseas FABs rather than by Intel here at home.

US Chip Manufacturing Makes a Comeback

Despite the setbacks, there have also been some positive developments recently.

TSMC is building its first FAB in the USA, in Arizona. Reportedly, it will eventually be capable of producing leading-edge 5nm chips, but it’s taking longer than expected for the new plant to come online due to supply chain problems and difficulty staffing the new factory. Chip production could begin in 2026.

Another bright spot in US semiconductor production is GlobalFoundries, which was formerly AMD’s chip hardware manufacturing arm before being spun off. GlobalFoundries doesn’t compete directly with TSMC’s most advanced chips, instead, they have concentrated their efforts on producing mainstream chips that are 12nm or larger.

New Announcements: More Domestic FAB Projects in the Pipeline

Intel is looking for a comeback. They are investing over $40 billion in new and upgraded chip facilities – including two new plants near Chandler, Arizona, two brand new fabs in Ohio (estimated to cost $20 billion, making it the largest economic development program in Ohio’s history), plus a major new semiconductor packaging facility in New Mexico.

The Korean leader in chip production, Samsung, is also building a state-of-the-art 5 nm semiconductor FAB north of Austin in Taylor, Texas. There are also signs that Samsung plans to build two additional fabs in the Austin/Taylor region as well, which if true, could come online on a rolling basis between 2034 and 2042.

Texas Instruments is expanding its analog chip business, with plans to build a new large fab near Sherman, Texas, with an estimated $30 billion investment over a decade; the first phase could come online as soon as 2025.

GlobalFoundries has announced its plans to build an all-new FAB in Malta, New York, as well as a $1 billion investment to increase its production at its existing FAB 8 plant.

Micron Technology has also announced the construction of two new FAB facilities to produce DRAM memory chips – one located in Clay, New York, and another near its headquarters in Boise, Idaho.

AI’s Insatiable Demand for Semiconductor Chips is Attracting Massive New Investment

The rapid development and adoption of AI technology will have an outsized impact on the semiconductor manufacturing market, and this expected high demand may help insulate the industry from a ‘boom-bust’ economic cycle.

The market leader, Nvidia is encouraging us to think “big.” At the annual SIGGRAPH Computer Graphics Association meeting, Nvidia promoted large, coordinated computer centers packed with high-end chips tuned for processing the large language models (LLMs) that power generative AI.

META, the parent company of Facebook, Instagram, and Threads, recently changed its strategic direction away from the meta-verse, planting both feet firmly into the AI arena. CEO Zuckerberg is expecting to spend up to $18 billion on 600,000 GPUs in 2024. Some of these advanced processors, such as Nvidia’s advanced H100 semiconductor chips for AI-based, will be housed in a new $800 million data center in Jefferson, Indiana. Interestingly, there are reports META will also pursue developing its own custom AI chips, reducing its dependency on Nvidia over time.

Finally, the recently ousted, and then hastily reinstated, CEO of OpenAI, Sam Altman, announced that he is seeking investment partners (reportedly including Abu Dhabi’s G42 and Tokyo-based Softbank) to raise billions of dollars toward building new AI chip manufacturing plants.

If the AI juggernaut continues to grow, the increased demand for custom AI chips could elevate the semiconductor manufacturing business even further – hopefully, this will also offer an opportunity for expanded manufacturing production in the USA in the coming years.

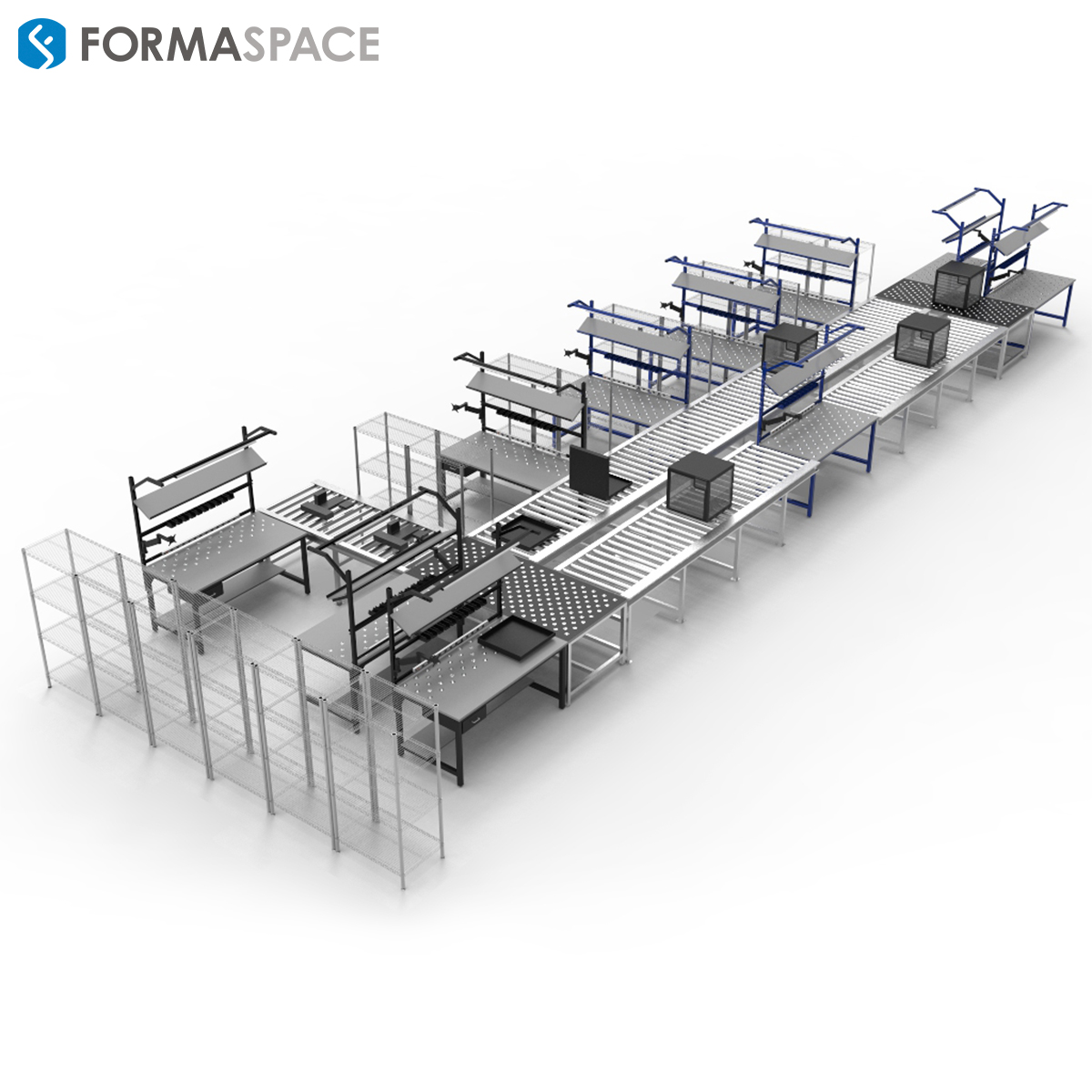

Formaspace is Your Chip Manufacturing Partner

If you can imagine it, we can build it, at our Austin, Texas, factory headquarters.

Talk to your Formaspace Sales Representative or Strategic Dealer Partner today to learn more about how we can work together to make your next construction project or remodel a success.