As we prepare to cross into the third decade of the 21st century, we can look back and see clearly how Digital Transformation has steamrolled its way across one industry sector after another.

Newspapers and magazines (once supported by lucrative print advertising business model) have been overtaken by online media, including new formats, such as blogs, vlogs, and podcasts. The software industry has also been transformed, with app downloads and subscription-based Software as a Service (SaaS) business models largely displacing permanent one-time software license sales. And in the transportation market, the app-driven “sharing economy” business model has muscled its way in to overtake traditional taxi and livery car services.

As the tech revolution has transformed industry after industry, what’s left on the table?

One of the last holdouts that has resisted Silicon Valley-style “rationalization” efforts has been the domestic freight industry and its highly fragmented carrier market, which is predominantly made up of independent truck drivers and small fleet operators (80% of which own less than 6 trucks).

As many entrepreneurs looking to crack this market have discovered, companies who ship goods to their customers are willing to pay good money to offload the burden of having to interface with this highly fragmented freight market.

Of course, the largest companies, such as Amazon or Walmart, have the financial wherewithal to invest millions to build up their own private shipping operations (including trucking operations, and in the case of Amazon, a private fleet of air cargo planes) to ship goods between their suppliers, distribution centers (DCs), major shipping carriers (such as FedEx, Ups, and the USPS), and their own fleet of delivery trucks.

But what are the options for smaller companies that lack the capital or inclination to start their own private transportation systems?

These companies are increasingly turning to a different class of outsourced freight operators, the so-called Third Party Logistics (3PL) companies.

3PL companies join the ranks of other successful business outsourcing models (such as outsourced payroll and benefits managers) that allow companies to focus on what they do best, leaving the messy details to a trusted third party.

The Covid-19 pandemic has only accelerated the uptake of 3PL operating agreements, particularly in the retail sector, as retailers facing plummeting brick-and-mortar sales have been looking for ways to ramp-up their online-commerce sales as fast as possible.

What Distinguishes Third-Party Logistics from Traditional Supply Chain Outsourcing Approaches, Such as Freight Brokers?

If you are a veteran of the logistics market, you might argue, “Wait a minute, isn’t this 3PL jargon just another name for a freight broker?”

Not quite.

The 3PL business model, which has its origins going back to the 1970s, has grown beyond its roots in managing warehousing and transportation operations. Today’s 3PL companies have expanded their remit to take on a much deeper role within the companies that hire them.

Unlike freight brokers, today’s 3PL service providers often have direct access to their client’s enterprise resource planning (ERP) software systems, enabling them to manage a wide range of supply chain operations, including production/order management, order fulfillment and billing, labeling and packaging, reverse logistics for product returns, freight forwarding, cross-docking and customs services for international sales.

This is how 3PL companies fit into the larger logistics outsourcing market.

First-Party Logistics: 1PL

Companies or agencies (including manufacturers, wholesalers, traders, retailers, distributors) that manage their logistics in-house when sending or receiving cargo.

Second-Party Logistics: 2PL

Carriers that offer a single stage of transportation within the supply chain, such as cargo ship container shipping companies or airlines providing air cargo services, as well as the agents who support them, including freight forwarders, freight brokers, shipping agents, etc.

Third-Party Logistics: 3PL

Third-Party Logistics service providers that enter into “deep” partnerships with in-house logistics personnel to take responsibility for managing one or more of these supply chain functions: procurement and/or manufacturing production, transportation/freight forwarding, DC/warehousing operations, order fulfillment/financial management, and IT services in transportation, material handling, or production management.

Fourth-Party Logistics: 4PL

There are often cases where a company does not have the necessary in-house expertise to manage an external 3PL partner but is hesitant to hand over the reins without detailed oversight. In this scenario, some companies elect to engage a consulting company, known as a Fourth-Party logistics partner, to oversee the management of their 3PL contracts. Fourth-Party logistics partners are also often brought in to manage multiple 3PL partnerships when a single third-party logistics company cannot offer full, end-to-end coverage of a client’s supply chain operational requirements.

Fifth-Party Logistics: 5PL

It’s a longstanding business principle that the biggest, highest volume customers generally get the best rates. As a consequence, companies relying on one or more small 3PL partners may not have the negotiating strength to get the lowest price on supply chain contracts, such as air freight or freight forwarding transportation services. So-called Fifth-party logistics service providers (also known as “aggregators”) can step in to aggregate orders across multiple 3PL companies to negotiate better rates from shipping companies or freight airlines.

8 Strategies for Successful Third-Party Logistics Providers

As we enter the peak shipping season, 3PL service providers will be put to the test.

Here are eight strategies to help your 3PL operations stand apart from the competition:

1. 3PL Service Providers Need to Establish a Trustworthy Working Relationship with Vendors

Third-party logistics providers need to earn the trust and confidence of their clients each and every day.

Of course, it goes without saying that 3PL companies need to meet or exceed the performance targets they have committed to as part of their client agreements, but successful 3PL companies can take this one step further by pro-actively providing extra levels of transparency and visibility for their clients.

Make it a habit to provide daily performance and exception reports that clearly identify any issues or problems you are experiencing; be sure to elevate items that need timely client input and direction. Good reporting practices will also make it possible for you and the client to identify emerging trends as well as spot issues before they become major problems.

Clients will want to pay particular attention to inventory management reports that identify lost or damaged inventory or an unexplained mismatch between inventory records and out of stock reports from the warehouse or distribution center. The client will also want to know which items failed to ship the previous day (and why) – to ascertain whether there is a vendor delivery issue or a 3PL receiving issue.

2. Protect Supply Chain IT Data Like it’s Your Own

It takes a lot of trust for companies to turn over access to their critical supply chain management and fulfillment operations to a third-party company.

Of particular concern is granting direct access to private data sources in the corporate ERP system, including the proprietary vendor lists and pricing agreements, customer lists and purchasing history, customer payment information, and other proprietary trade secrets.

Nothing will make the relationship with the client term shift from a friendly one to a potentially litigious one faster than compromising any of these proprietary data sources.

It’s imperative that 3PL service providers invest in state-of-the-art cyber protection strategies and conduct regular drills to practice responding to cyber-attack.

Of course, any eventual cyber compromise could ultimately be the fault of the client’s own lax security hygiene procedures; however, a breach is a breach, and the 3PL provider may get caught in the crossfire even if they are not directly at fault.

For this reason, it’s probably a good idea to share your cybersecurity expertise with clients who may need assistance as part of your “value add” service offerings.

3. Consider a Specialization Focus to Differentiate Your 3PL Operations

When it comes to 3PL service providers, there is more than one “800-pound gorilla” in the room.

FedEx Supply Chain Services and UPS Supply Chain Solutions dominate the transportation-focused sectors of the 3PL offerings, while Amazon Marketplace and Walmart Marketplace both offer comprehensive third-party fulfillment solutions for small vendors, especially those wanting to gain entry into fast-growing “drop ship” segment of the e-commerce market.

Given the strong competitive landscape, how can smaller 3PL service providers be successful in the face of these industry giants?

One strategy is to pursue specialization. Successful smaller 3PL companies tend to identify niche areas in transportation services, warehousing and distribution centers, freight forwarding, financial operations, or information technology services.

Another way smaller 3PL companies can differentiate their offerings is to specialize in market sectors that larger, high-volume giants might find difficult to penetrate.

Some examples of this include specializing in cold storage fulfillment operations (e.g. seafood, meat, perishable groceries, etc.), handling high-value or highly regulated goods (e.g. hazardous materials, precious metals and jewelry, financial instruments and specie, or even scheduled pharmaceuticals which require a documented chain of custody, etc.), or those transactions that require detailed paperwork (such as international transactions requiring complex customs transactions, international tax payments, reimbursements, etc.)

4. Leverage Collected Data to Power Up Logistics Operational Efficiency

It’s no longer a question of who collects the most toys; we now live in a world where the one who collects the most data wins.

Even if your client thinks that your main mission is to manage the day-to-day operations of order fulfillment, you should never lose track of your primary objective – which is to collect all possible forms of useful data that can provide future insights that will make your logistics operations more nimble and efficient.

There are many opportunities to improve data collection.

And, it might surprise outsiders not familiar with the freight forwarding industry that over the road shipments, particularly those hauled by independent truckers, have only recently been brought under the umbrella of real-time data collection systems, such as GPS tracking.

5. Turn to Software Specialists for Expertise in AI-Driven, Big Data Automation

But collecting data is one thing; analyzing it is another.

Despite the fact that 3PL service providers are (by definition) an outsourced resource, it may be uncomfortable for many 3PL companies themselves to realize they too may need to outsource some of their core functions – particularly in the IT automation arena.

The reality is that unless the 3PL company in question has software development and data analysis as its core competency, partnering with another company specializing in data analysis will be a requirement, if not now, then soon.

Why?

Today’s data scientists and programmers around the world are laser-focused on solving challenging mathematical problems (such as the “Traveling Salesperson Problem”) that affect the logistics industry.

As a result, big data analysis and artificial intelligence solutions are advancing quickly throughout the supply chain logistics market, making it difficult for independent 3PL companies that are not specializing in IT to keep up without a technical partner.

Due diligence is the word when selecting an IT partner, however. Not only is there a risk of betting on the wrong horse, you may adopt a platform that is ultimately gobbled up by one of your larger competitors (such as Amazon, or FedEx, etc.)

Despite these challenges, it’s clear that advances in software (particularly AI-powered automated decision-making tools) are here to stay. These tools are proving themselves today at bigger companies (such as Amazon) that use big data analysis to forecast future orders, manage deliveries, avoid expired products (such as produce), assist with returns, track inventory, minimize annual tax liabilities, and perform thousands of other real-time optimizations.

If tech forecasters are right, even the trailing edge of technology, the over-the-road trucking industry, will be completely revolutionized in the coming years, thanks to major IT advances in developing autonomous self-driving trucks.

6. Rethink DC Site Selection for More Efficient Logistics Coverage

Demand for overnight (or even same day) delivery was strong before, but the advent of the Coronavirus pandemic has caused demand to skyrocket. And we’ll see how well the fulfillment industry can cope with this increased demand as we enter the peak delivery weeks of the 2020 holiday season.

3PL companies focused on warehousing and distribution center (DC) operations will likely be very familiar with the changing site optimization strategies when it comes to locating DCs and warehouses.

In the not too distant past, inexpensive acreage in rural locations (with easy access to major interstate highways) was a good bet for siting distribution centers and warehouses.

Inexpensive land prices and property taxes encouraged low rise developments spread over thousands of square feet, kitted out with an ample number of loading docks and large parking spaces designed to facilitate quick turnarounds for shipping and receiving.

Increased customer preference for overnight delivery has changed the equation significantly.

Logistics planners are now finding it necessary to bite the bullet and acquire more expensive real estate located closer to bigger population centers in order to meet overnight delivery demand.

Amazon, in particular, has identified a workable strategy of acquiring underutilized or defunct shopping centers that can be converted into smaller distribution centers with faster access to suburban or city dwellers.

7. Optimize DC Layouts to Improve Material Handling Workflow and Increase Shipping Throughput

Site selection is not the only way that supply chain logistics managers are optimizing warehouses and distribution centers for fast fulfillment delivery.

Another strategy that real estate investors (such as are REITs) are pursuing is converting urban locations into multi-story warehousing and distribution centers modeled after those typically found in denser urban locations in Europe or Asia. These multi-story facilities are more complicated to build (in many cases, developers also need to create multi-story ramps and loading dock areas for trucks, adding considerable expense to the project), but the ability to access potentially hundreds of thousands if not millions of people within a short drive offers the promise of a strong return on investment over the long haul.

Modern warehousing and distribution centers designs can also be very specialized to serve particular logistical functions. Take cross-docking, for example, which, much like hub-and-spoke airline services, relies on careful timing of receiving goods so they can be immediately shipped out again (without having to take up warehouse space). To optimize the design for cross-docking, DCs need to have much larger receiving areas (as well as a potentially larger number of loading docks) to handle the increased volume during cross-docking operations.

8. Build in Flexibility to Achieve a Best-in-Class Mix of Worker Productivity and Robotic Automation

The increased demand for overnight order fulfillment is pushing every system to the limit.

As a result, even the smallest inefficiencies (each of which might slow things down by just a few seconds) can add up to significant delays when you multiply the cumulative effect throughout the system.

For the moment, human workers are at the heart of most warehousing and distribution center operations, so it’s critical to not only provide them with the tools they need to work at peak efficiency but also provide comfortable, ergonomic work spaces that helps prevent workplace injuries on-the-job.

Of course, automation systems are becoming more commonplace, with robot picking systems being one area that is seeing a large uptake by the fulfillment industry.

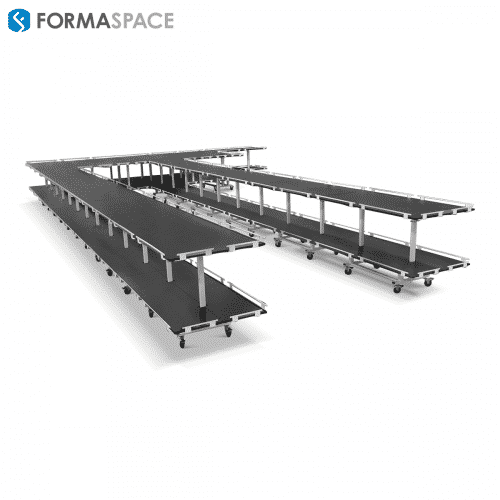

How can you manage this change? The answer lies in focusing on the human-robot interaction by specifying flexible modular industrial furniture solutions that can be reconfigured as new technologies get introduced or operational requirements change.

Also, take the time to prototype new material handling systems before implementing them across the board. As a leading manufacturer of industrial furniture systems, Formaspace has found that working closely with warehousing and distribution center operators, we can create fully functional prototype systems that can be tweaked and optimized – based on real-world conditions – before committing to a system-wide change.

Formaspace Is Your Logistics Partner

If you can imagine it, we can build it, here at our Austin, Texas factory headquarters

Formaspace is a leading American-made industrial furniture company with deep expertise in providing innovative furniture solutions for warehousing and distribution center facilities, manufacturing and assembly plants, clean room facilities, research laboratories, and educational facilities.

Want to know more?

Speak your Formaspace Design Consultant today to find out how we can lend our years of expertise to help make your next project a success.