We looked at how Walmart integrated distribution technology as part of its strategy that led it to become the largest US retail by sales revenue in 1990. This week we will look at Amazon and its aggressive approach to distribution.

Back in 1990, when Walmart’s revenue first exceeded its primary retail rivals Sears Roebuck and Kmart, Amazon did not yet exist. It wasn’t until four years later, that Amazon founder Jeff Bezos left his job as an investment banker at D. E. Shaw and Co. in New York City and moved to Seattle to develop the Internet-based business plan that led to the birth of Amazon.com. Bezos initially sold books online — out of his garage in Bellevue, Washington. After two months in business, his young Amazon.com website had a sales run rate of $80,000 of books per month. Within three years, Amazon went public.

Today, twenty years after its founding in 1994, Amazon has nearly 120,000 employees and annual revenue of nearly $75 billion US. Not only does it sell practically every consumer product imaginable, from books to cosmetics to apparel to household durable goods, it also is a major outlet for many business-to-business oriented products and services.

nbsp;

Why the Initial Focus on Book Sales at Amazon? Amazon’s Long-Tail Fulfillment Warehouse Strategy.

Clearly, Jeff Bezos likes books, but as an entrepreneur, his approach was agnostic as to which product line or business model to employ as his entry point into the burgeoning Internet marketplace. Bezos observed that online book sales offered unique advantages over traditional brick-and-mortar bookstore retail operations. A key advantage for online book sales is the searchable online catalog. Once Amazon achieved a critical mass of available inventory, it could offer consumers a breadth and depth of titles that far surpassed anything that could be physically stocked in a local bookstore or retail book chain. This “long-tail” approach plays to the strengths of Amazon’s centralized distribution system that offers rapid the fulfillment to consumers at low cost.

Amazon’s Choice of Fulfillment Warehouse Locations Influenced by Internet Sales Tax Policy

In its quest to offer books to customers at the lowest possible cost, Amazon also aggressively pursued what could charitably be called a “non-traditional” strategy for the location of its fulfillment center warehouses. In a traditional network of distribution centers, operations managers and supply-chain experts would typically spread out their warehouse distribution fulfillment centers across the country to maximize efficient access to large population centers.

However, this was not the case for Amazon, particularly in its early days. Amazon took note that most states charging sales tax did not require vendors to collect the sales tax on behalf of their customers — as long as the vendor was out of state and did not have any physical location ( or nexus) within the state. Consequently, Amazon, in its early days, deliberately chose to place its distribution centers in those states which either did not charge sales tax or in states with smaller populations which could efficiently service nearby states with large populations in order for those consumers to shop tax-free.

The bottom line for consumers was positive, but negative for state governments relying on sales tax and brick and mortar bookstores who had to charge sales tax.If you bought from Amazon, chances were that you wouldn’t have to pay sales tax, even if you really were obligated by law to self-report and send the tax money to your local state government. In round numbers, tax-free shopping on the Internet was equivalent to a constant 10% discount on Amazon’s already low book prices. State governments cried foul as they saw their sales tax dollars evaporating as a result of Amazon’s aggressive approach (in their view) to state sales tax avoidance. California argued that Amazon had hundreds of “sales affiliates” within the state. These affiliates, which promoted Amazon on their websites in exchange for a small finders’ fee, were a local nexus (or physical location) in the state according to California. Also, Texas argued that Amazon’s Dallas-Fort Worth area fulfillment distribution center subsidiary was also a nexus; thus Amazon needed to collect state sales tax on its online sales to Texas consumers. After some serious negotiations, both California and Texas governments achieved their goal and Amazon began collecting sales tax. In exchange, Amazon received some incentive tax credits for building distribution centers in California and in Texas.

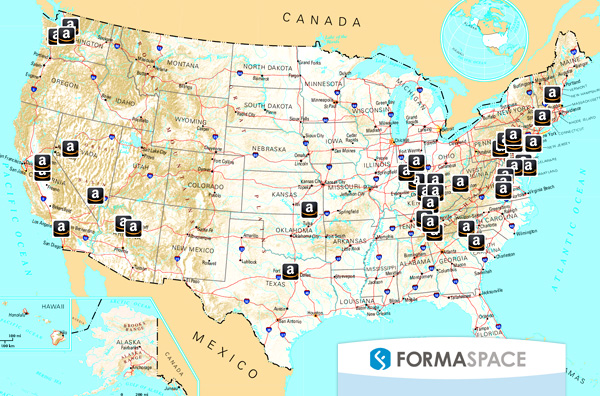

Current Amazon FBA Fulfillment Warehouse Locations in the US

According to MWPVL International, Amazon has about 50,000,000 square feet of fulfillment center warehouse space in the US, in current operation (or planned to open in 2014.) Additionally, Amazon has approximately 25,000,000 square feet of fulfillment center warehouse space outside of North America. While this is less square footage than Walmart has within the US (in 2014 Walmart had 157 distribution centers with 118,000,000 ft.² ), Amazon is growing more rapidly. MWPVL estimates that in 2014 Amazon will open ten new U.S. locations exceeding 8,600,000 square feet and six overseas locations totaling 6,500,000 square feet.

How Does Amazon Categorize it’s Fulfillment Warehouses?

Presently, there are seven types of distribution centers which service Amazon’s growing customer base:

- Large Sortable Fulfillment Warehouses: Processes items which can fit into a large box.

- Small Sortable Fulfillment Warehouses: Processes items which can fit into a small box.

- Non-sortable Fulfillment Warehouses: Processes items too large for box shipment.

- Replenishment Warehouses: Transfer center to move goods from manufacturers to other fulfillment centers.

- Customer Return Warehouses: Returns for damaged, missing, unsatisfactory or incorrectly shipped items.

- Specialty Items Warehouses: High dollar items such as jewelry or specialty apparel.

- Grocery Item Warehouses: Dry goods and Perishable items, like meats, dairy, vegetables

A Day in the Life of an Amazon Fulfillment Warehouse “Picker”

It may come as a surprise to frequent users of Amazon’s famous patented ‘One Click’ sales button that even in 2014 the fulfillment process is still fairly manual. At each of its warehouse fulfillment centers, Amazon employees manually receive shipments of goods from manufacturers. They have to unload, unpack, inspect and place all the shipments into warehouse storage at the proper location, which is recorded in the computerized central inventory system. When you place an order, the computer sends out the request to one or more distribution centers, where a ‘pick list’ is generated. The pick list is what the Amazon warehouse worker or ‘picker’ uses to walk through the large warehouse facility accompanied by what is essentially a large shopping cart. Pickers keep track of their pick list tasks and progress on handheld mobile computers. These mobile computers also monitor the efficiency of the picker, who must maintain a brisk schedule as they walk throughout the facility, often more than 10 miles each day. Here is a short video which shows the pickers in action, circa 2009:

http://www.youtube.com/watch?v=i6H7nfHjHtY

Some Amazon workers in the US and in the UK have complained about the pressure they face on the job to keep up with Amazon’s promise of overnight shipping. However, things may change for these workers altogether in the near future, as we’ll see in the next section.

Amazon Warehouse Automation with Kiva Systems

The need for so many manual pickers may be reduced significantly in the future as robot technology enters the field. In 2012, Amazon purchased Kiva Systems, a warehouse automation company. Kiva promises its integrated robot and ‘pod’ hardware and software solutions will speed up cycle times as consumers increasingly demand next day or even same-day delivery. They also promise to handle some of the particular issues facing operational teams at warehouse distribution centers. These include:

- Need to improve pick accuracy to avoid losing a customer who is inadvertently sent the wrong product.

- Increase flexibility and scalability to handle unexpected surges in consumer preferences as well as traditional seasonal shopping effects (winter coats versus bathing suits).

- Address efficient storage of long-tail inventory.

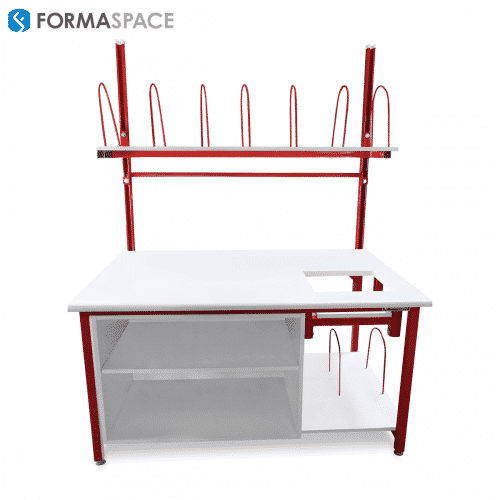

If You Are in the Fulfillment Warehouse Distribution Market, Formaspace Can Help

Whether you are a retail giant or a local distributor, contact us here at Formaspace and speak with one of our technical furniture consultants today. We offer a wide range of industrial packing tables, sorting tables and industrial workbenches that can help you operate more efficiently. And all our furniture is backed by a 3 shift continuous use guarantee for twelve full years. No one else backs their products like Formaspace does.