To say 2020 has been a difficult year for the American manufacturing companies would be an understatement.

It wasn’t meant to be this way.

According to the Congressional Research Service, China displaced the United States as the largest manufacturing country during the Great Recession years. The US share of manufacturing dropped from 28% in 2002 to a low point of 16.5% in 2011. By 2016, US manufacturing’s share of world output was recovering from its decline during the Great Recession, reaching a 7 year high of 18%.

Things were looking so promising for a recovery in American manufacturing that consulting giant Deloitte forecast in their 2016 Global Manufacturing Competitiveness Index that the US would return to its number one global ranking by the year 2020, followed by China then Germany.

But that forecast was made before the disasters of 2020 unfolded, most notably before the global Covid pandemic, which has disrupted factory production and international supply chains around the world. But other factors are at work as well, such as the imposition of new emergency of new trade barriers as part of an attempt by Washington to decouple America from doing business with China.

The US response to the pandemic has also prolonged the difficulties for American manufacturing. At the moment, most of China’s manufacturing workforce has been able to return to factory production, while here in the US, we appear to be on the cusp of a wintertime Covid-19 wave that may exceed the worst disease outbreaks of the spring and summer.

All is not lost, however.

As of November 2020, hope for a recovery is around the corner in the form of two promising vaccines (and possibly more) that could turn things around in 2021.

Now is a good time to reflect on where US manufacturing capabilities stand relative to other countries and what policy changes and investments we can make to support a continued renaissance in American manufacturing.

We’ll look at three areas: the importance of developing an Innovative and Productive Workforce, the need to maintain a Favorable Business Climate, and the power of Super-charged Network Effects.

Competitive Advantage #1: An Innovative and Productive Workforce

The combination of leading-edge innovation and an educated, productive workforce (human capital) is widely seen as the most important factor in achieving long-term success in the manufacturing sector.

Investment in Innovation

The manufacturing industry has been a leader in high tech innovation for decades, but the newest disruptive technologies (falling under the “Industry 4.0” banner, including 5G, AI, electric and autonomous vehicles, IoT, and the solar/battery renewable energy transformation) are already creating new industrial champions, such as Tesla Motors, that will change the course of manufacturing history.

But is the US investing enough?

The US once led the world in basic science and education, but Deloitte reports that US investment in basic research has been stagnant, while Chinese investment, albeit starting from a lower basis, has risen quickly. The Chinese government has also made a greater investment in technical schools and universities and proudly points to the greater number of published Chinese research papers and new patents, as well as impressive infrastructure projects, such as a network of high-speed trains as well as a burgeoning aerospace program.

Verdict: South Korea, China, and Taiwan lead the world in relative R&D spending; China is rising while US research investment is stagnant.

Brain Drain

For decades, countries around the world have struggled with how to combat “brain drain” – the loss of their best and brightest who have migrated (most commonly to the US) for better education and greater opportunities.

But the Coronavirus pandemic and recent US immigration changes may be upending this long-standing inflow of talented immigrants into the US. As American universities and colleges turn to virtual classrooms in response to Covid, US immigration has attempted to cut off access to foreign student visas, leading many international students looking to advanced education opportunities in Europe instead. Chinese nationals living in the US have also come under intense scrutiny, with several high-profile researchers having been accused of industrial espionage thanks to their ties with Chinese mainland institutions.

Of course, we cannot condone any illegal spying activities, but creating a hostile environment for talented immigrants is counterproductive at a time when countries around the world are seeking out the best and brightest experts in artificial intelligence, syntax, manufacturing technology, autonomous vehicles, and other media technologies that will drive the economy in the coming decades. The optics are not good when seen from the eyes of potential immigrants.

One question we should ask ourselves: “Would a future ‘Elon Musk’ choose to emigrate from South Africa to the US or China?”

Verdict: The US is at potential risk for Brain Drain

Worker Productivity

According to the 2018 Brookings Global Manufacturing Scorecard, the productivity of US manufacturing workers rates among the best in the world –thanks to increased investment in automation and high tech manufacturing – allowing the US industry to succeed despite having some of the world’s highest labor costs.

But challenges remain. Around the world, populations are aging, and the demographic shift adds pressure on maintaining a sufficient pool of productive workers. Another issue facing American manufacturing is the perceived prestige level of manufacturing work; unlike their European or Asian counterparts, many highly training science and engineering graduates perceive manufacturing careers as having lower prestige compared to careers in software, fintech, or other high tech industries.

Another challenge facing the US is middling test results in STEM education. The US continues to rank in the lower tiers in math and science exams compared to other industrial countries.

More effort is needed to motivate students to learn about the benefits of a career in manufacturing through efforts such as increased STEM education, mentoring programs (especially for young women), greater access to Maker Spaces to encourage young minds to “build” things, and more industry-led internship programs to help students step into the manufacturing industry.

Verdict: The US needs to grow its future manufacturing workforce by connecting with students at a young age.

Competitive Advantage #2: Favorable Business Climate

With a few notable exceptions, the US manufacturing industry enjoys a favorable pro-business climate.

Energy Costs

The transformation of the US energy market has, over the past two decades, been remarkable. Thanks to increased adoption of renewable energy and tracking technology to exploit domestic oil and gas production, the US has become energy independent for the first time in over 70 years.

Abundant supply of inexpensive energy is an important advantage for the manufacturing industry, which is one of the most energy-intensive sectors in the economy. One concern on the horizon is whether the recent dramatic slump in oil prices will knock domestic oil and gas production rates down permanently due to well shutoffs as production companies exit the market.

Verdict: The US enjoys favorable energy costs at the moment, though risks may lie ahead.

Worker Benefit Costs

For years, critics pointed to high US labor costs as the primary reason for faltering domestic manufacturing output. And indeed, many manufacturers, particularly in the apparel, automotive, furniture, and electronics market, have moved to offshore production in search of lower wage costs.

However, thanks to increasing wage costs in China and relatively stagnant wages in the US, the difference between the two top rivals is no longer is great as it once was. Difficulties in maintaining long supply chains during the coronavirus pandemic appear to be convincing many companies to consider re-shoring their manufacturing operations back to the US.

Challenges remain, however: US employers continue to face massive increases in the cost of providing health care to their workers. This puts US manufacturers at a major disadvantage compared to other countries that fund healthcare directly through some form of universal healthcare systems.

Many industrialized countries also offer subsidized child care to families, which allows parents to more easily reenter the workforce, increasing the overall labor pool.

Verdict: US labor costs are still higher than in China, but not as high as before. Healthcare costs are a heavy burden for US manufacturers.

Financial System: Taxes, Interest Rates, Currency Exchange Rates, and Capital Markets

When we think of business-friendly policies, taxes are often at the top of the list.

In many cases, it’s hard to make an “apples to apples” comparison of tax rates between the US and other countries. The nominal US corporate tax rate is not the lowest in the world; however, US tax regulations provide for a myriad of deductions that reduce the nominal tax rate significantly.

Overall interest rates have remained low around the world since the Great Recession (with some countries even dipping into negative interest rates at times), which is good news for manufacturing companies wanting to invest in new technologies.

Currency exchange rates have also been relatively stable over the same time period, with the exception of the Chinese yuan, which critics contend that the Chinese government has intentionally manipulated to a lower value to help Chinese manufacturers after the US imposed emergency tariffs on Chinese imports. Fortunately, we have not seen the wild swings in currency rates that plagued us in the 70s and 80s (particularly the UK pound and the German Deutschmark), although many economists continue to push for a lower US dollar to increase American exports.

Capital markets are another area of US strength that benefit the manufacturing industry. The US has a robust venture-capital and Angel investment market that helps new, innovative companies grow rapidly. The promise of a lucrative IPO continues to drive entrepreneurial ambitions in the US, which is good news for the manufacturing industry as well.

China wants to build up its own financial markets centered around Shanghai, but, as the recently failed ANT Group public offering by Alibaba-founder Jack Ma show, they have a way to go to create investor stability and trust.

In Europe, the threat of a “no deal” Brexit starting on January 1, 2021, could weaken European capital markets as the UK and EU governments argue over whether London’s financial markets will continue to have unfettered access to European markets; this could strengthen US financial markets in New York as well as Shanghai in China and Singapore.

Verdict: The US enjoys low tax and interest rates, a stable currency, and financial markets that are conducive to investment.

Legal System and Regulatory Environment

Critics point to dangerous working conditions, underage labor, and lax environmental protections as key factors that prevent American manufacturing from competing on a level playing field with overseas factories, particularly in sectors such as textiles and apparel.

Conditions may be changing in China, however, as workers not only demand higher wages but also better factory conditions. We will also have to see whether China follows through with greener environmental practices in line with its stated goal to become carbon neutral by 2050.

The US departure from the Paris Climate Agreement has called into question whether the US remains committed to environmental protection; the new administration coming in January may set a different course.

Meanwhile, as wages rise and regulations become more stringent in China, analysts see the low-tech, low-wage work moving to the so-called MITI-V countries (Malaysia, Indonesia, Thailand, India, and Vietnam), which poses a further challenge to American manufacturing interests.

When it comes to legal systems, US manufacturers have an advantage. The US (and UK) legal jurisdictions are considered among the most robust and fair (if not fast) in the world, and criminal activities such as bribery and racketeering are actively prosecuted here at home.

However, it’s becoming increasingly difficult to maintain functional legal frameworks between countries as the WTO and other international trade organizations come under attack. From the US perspective, lack of intellectual property (IP) protection and continued industrial espionage continue to be a problem in Asian countries. And, as data acquisition becomes a more important commodity, new legal disagreements will arise between nations over data storage and privacy protections.

Verdict: The US faces continued challenges from countries that do not adhere to international standards for workers, environmental, and IP protections.

Government Industrial Strategy

Government industrial policies that direct specific investments have been out of favor in Western countries since Margaret Thatcher dismantled the state-ownership of the UK’s industrial sector in the early 80s and the ex-communist Soviet states in Eastern Europe adopted the capitalist system after the Berlin wall opened in 1989.

Yet, the rapid rise of the Chinese economic powerhouse puts the spotlight back on the free market? Can capitalist business environments compete successfully against economies that are largely run by state control?

Bloomberg recently published a thought exercise in the form of a report from the future where economists in 2050 looked back on the continued rise of the Chinese economy and how it came to become the undisputed economic superpower in the world.

Indeed, over the past decade, we’ve seen rising tensions between free-market versus planned economies.

The Chinese government has been executing strategic plans to dominate health care and medicine technologies, 5G telecommunications, and artificial intelligence capabilities, just to name a few.

How Western governments react to China’s success in pursuing these rapidly growing industrial markets will have a great impact on the American manufacturing sector.

There are many questions to be asked; for example, is protectionism an effective strategy (such as banning 5G equipment from Huawei) in competing effectively against the rapidly advancing Chinese industrial sector?

Verdict: The US needs to find an effective strategy to compete against countries pursuing strategic industrial policies.

Competitive Advantage #3: Super-charged Network Effects

Our final category touches on the impact that so-called network effects have on the manufacturing industry.

You may be familiar with this term from the world of social networks where, for example, the more users that Facebook has, the more useful the service becomes to its users, which, in turn, drives more users to the service.

Product Standards

Both formal and de facto product standards can have an outsized “network effect” on the success of the company’s products and services.

Companies that achieve market dominance (often by getting there first, the so-called first mover advantage) tend to want to develop de-facto standards to control the market and increase their market share over time. The Apple iPhone ecosystem is an example of this; as more and more users adopt the iPhone, a greater number of developers want to participate by building applications and new functions for the iPhone, which, in turn, increases its overall value to the user and increases its user base.

Formal standards, such as those ratified by international committees or by government agencies, greatly influence the market for industrial goods as well. Sometimes formal standards help encourage innovation and competition by creating more open standards that encourage a level playing field. Other times, formal standards can limit competition.

To date, US manufacturing companies have generally benefited from creating product standards, from Windows computers to android phones.

On the other hand, some foreign companies, such as Huawei, have been very strategic in helping shape international standards for 5G technologies, which later helped them grow market share. This type of competition for establishing product standards will be a growing issue as new technologies emerge in the coming decades.

Verdict: US companies have enjoyed success to date in establishing product standards but need to be vigilant in pursuing new opportunities.

Concentrated Manufacturing Hubs

The rapidly growing city of Shenzhen outside of Hong Kong is an electronics manufacturing hub like no other. While the US has Silicon Valley (known for its entrepreneurship and product design prowess), Shenzhen has the strength and depth of manufacturing know-how that rivals Detroit’s automotive manufacturing heyday in the 20th century.

Why are concentrated manufacturing hubs so important?

For Shenzhen, it’s speed. With a strong supplier base at the ready, Shenzhen manufacturers can order custom electronics components or even outsource entire projects with breathtaking speed.

The US real estate market has a few areas of industrial research and manufacturing concentration – in addition to Silicon Valley; bio tech companies are concentrated in San Francisco and San Diego on the West Coast, and New Jersey, NYC, and Boston on the East Coast. And, of course, we have a well-established automotive manufacturing hub in Detroit. And Austin has a growing electronics manufacturing business, but compared to those in Shenzhen or in Taiwan, we aren’t there yet.

Concentration hubs not only bring suppliers together, they draw together a talented workforce looking for high-quality jobs in their chosen field. Advanced educational facilities often follow, providing additional investments in all-important “human capital.”

Verdict: The US needs to encourage the growth of concentrated manufacturing hubs.

Home Markets, Trade Blocks, and Tariffs

Our final consideration for evaluating the future health of US manufacturing is the growing importance of trade blocks and available local markets.

The world is increasingly divided into three mega trade blocks:

USA – Canada – Mexico, under the USMCA free trade agreement (successor to NAFTA)

European Union common market / EEA (European Economic Area)

The Regional Comprehensive Economic Partnership (RCEP)

Not familiar with the RCEP? It’s the new Asia-Pacific trade agreement ratified just this month by Australia, Brunei, Cambodia, China, Indonesia, Japan, Laos, Malaysia, Myanmar, New Zealand, the Philippines, Singapore, South Korea, Thailand, and Vietnam.

(RCEP is the successor treaty to CPTPP, an effort that failed when the US and India pulled out.)

In a world where governments (such as the US currently) believe in “de-coupling” from global trade, it’s likely that these major trade blocks will have a greater influence on the future of manufacturing companies.

How so?

Within each of these giant blocs, manufacturing companies will be able to access large “local” markets that facilitate trading thanks to common standards and reduced tariffs.

The USMCA consumer market in North America is large indeed, but is it large enough for American manufacturers? That’s a question for the government to answer. We may see movement toward rejoining the Asia-Pacific block in the coming years.

Verdict: The US is well positioned in the USMCA free trade bloc, but may want to expand free trade to compete with Asian manufacturers.

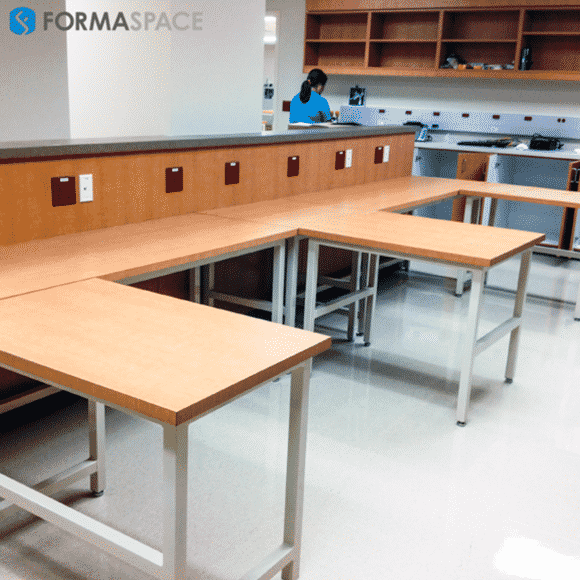

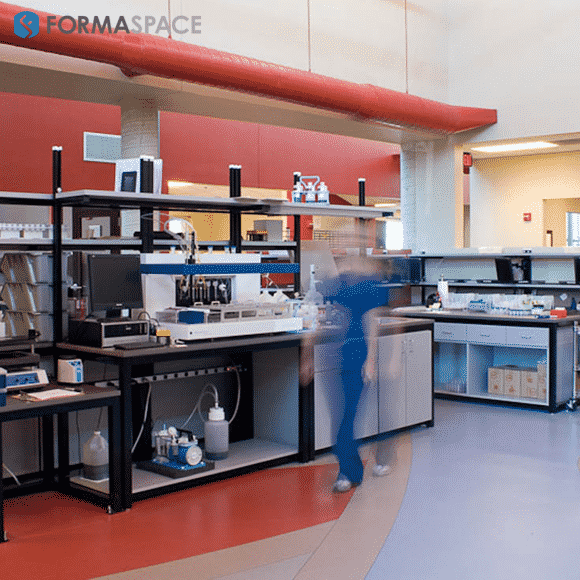

Formaspace is Your Manufacturing Partner

If you can imagine it, we can build it, here at our factory headquarters in Austin, Texas.

Whether you are looking to build or expand your manufacturing operations, research laboratories, healthcare facilities, or educational institutions, we can help you.

Find out why companies such as Apple, Dell Computer, Google, Oculus, SpaceX, Toyota, and Yeti turn to Formaspace for their industrial furniture needs.

Take the next step. Contact your Formaspace Design Consultant today.